In the intricate world of personal finance, understanding your earnings is paramount. Yet, navigating the complexities of taxes, deductions, and withholdings can be daunting. This is where a salary paycheck calculator comes to the rescue. In this article, we explore the significance of this invaluable tool in managing your finances effectively.

Understanding Your Take-Home Pay

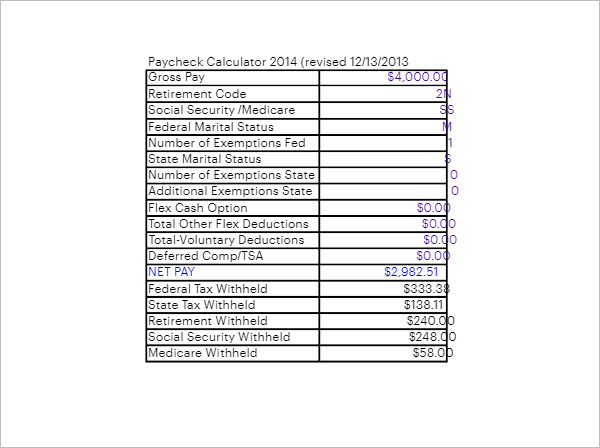

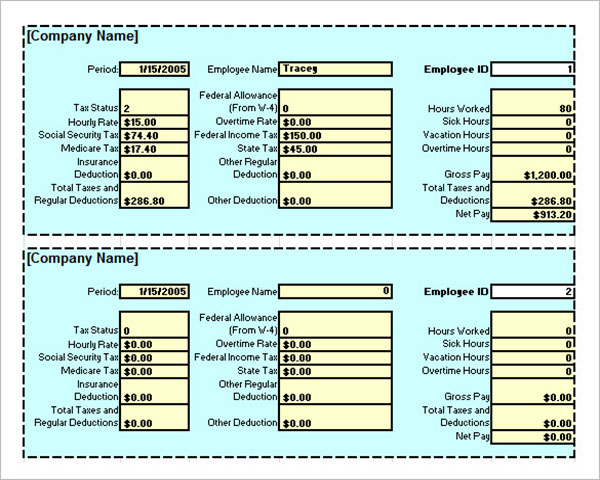

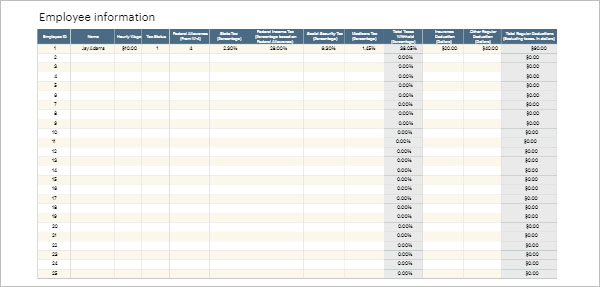

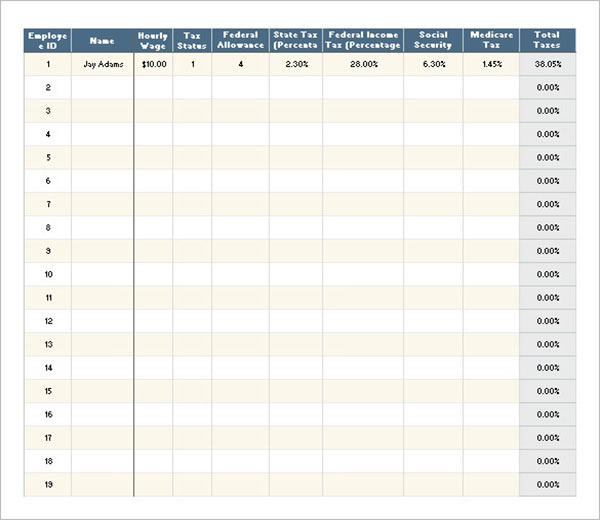

At first glance, your salary offer might seem enticing, but what you actually take home is what matters most. A salary paycheck calculator provides a detailed breakdown of your net pay after taxes and deductions. By inputting your salary, filing status, and any additional withholdings, you can obtain an accurate estimate of your take-home pay. This knowledge empowers you to make informed financial decisions and budget effectively.

Navigating Tax Season with Ease

Taxes are a reality of life, but they need not be a source of confusion. This calculator takes the guesswork out of tax calculations by automatically factoring in federal, state, and local taxes based on your jurisdiction and filing status. Whether you’re a salaried employee or an independent contractor, this tool provides clarity on your tax liabilities, ensuring compliance with tax regulations and avoiding surprises come tax season.

Planning for the Future: Retirement Contributions and Savings

Saving for retirement is a long-term endeavor that requires careful planning. A salary paycheck calculator allows you to simulate the impact of contributing to retirement accounts such as 401(k)s or IRAs on your take-home pay. By adjusting contribution amounts, you can gauge how your retirement savings goals align with your current financial situation. Planning ahead ensures that you’re on track to achieve financial security in your golden years.

Accounting for Deductions and Benefits

Beyond taxes and retirement contributions, your paycheck may be subject to various deductions and benefits, such as health insurance premiums, retirement plan contributions, and flexible spending accounts. A salary calculator considers these factors, providing a comprehensive view of your earnings and expenses. Understanding these deductions allows you to evaluate the true cost of employment benefits and make informed decisions during open enrollment periods.

Empowering Financial Wellness

In an era of increasing financial complexity, financial literacy is a valuable asset. A salary calculator serves as a tool for promoting financial wellness by demystifying the intricacies of your earnings. By gaining insight into your take-home pay, tax liabilities, and retirement contributions, you can make informed financial decisions, set realistic goals, and work towards financial stability and prosperity.

Conclusion: Harnessing the Power of Knowledge

In the journey towards financial well-being, knowledge is key. A paycheck calculator empowers individuals to take control of their finances by providing transparency and clarity. By understanding the components of your paycheck and the factors that impact your earnings, you can navigate the financial landscape with confidence and make decisions that align with your goals and aspirations.

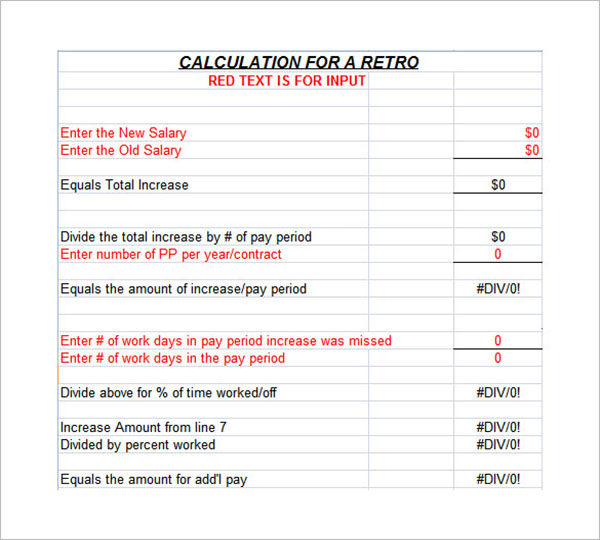

Salary Paycheck Calculator

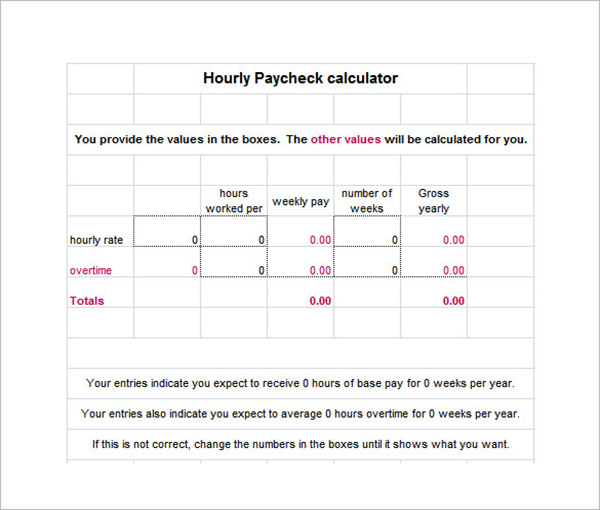

Excel Hourly Paycheck Calculator Free Download

Employee Salary Paycheck Calculator

Sample Hourly Salary Pay Rate Calculator

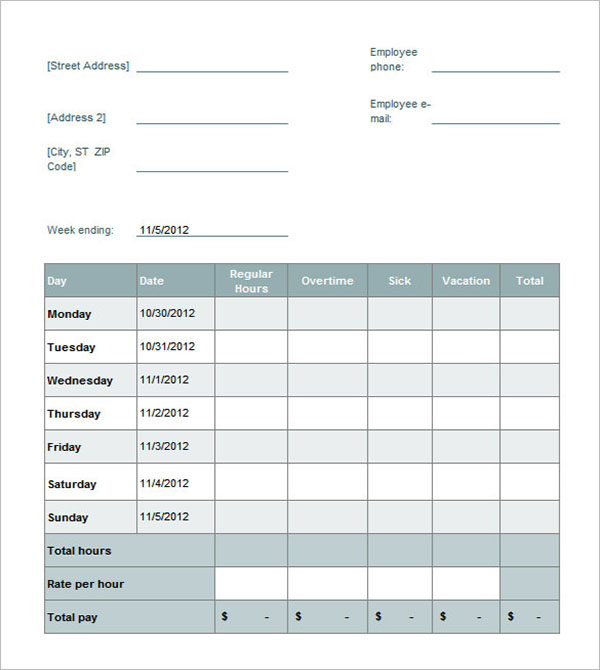

weekly Paycheck Calculator

le=”text-align: left;”>Free Download Salary Paycheck Calculator</h2></h2></h2>

ass=”yoast-text-mark” style=”text-align: left;”>>Salary Paycheck Calculator Example</h2>

<h2 class=”yoast-text-mark” style=”text-align: left;”>>Salary Paycheck Calculator PDF</p>

le=”text-align: left;”>Hourly Salary Paycheck Calculator Word Download

Paycheck Calculator Excel Template

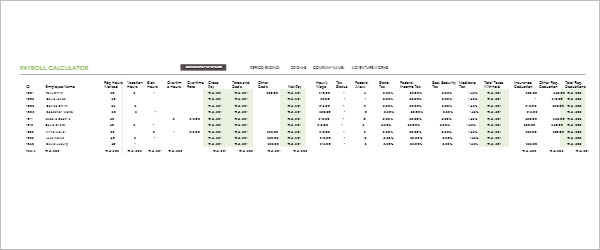

Salary Payroll Calculator Template

Sample Salary Payroll Calculator XLS