Best Invoice Templates for Businesses: A Complete Guide

In today’s fast-paced business world, managing finances and keeping records organized is essential for success. One of the easiest ways to streamline your billing process is by using invoice templates. Whether you run a small business, freelance, or manage a large company, having professional and customizable templates helps you save time, maintain accuracy, and build trust with your clients.

What Are Invoice Templates?

Invoice templates are pre-designed documents that include essential fields like company name, client details, services or products, prices, taxes, and payment terms. Instead of creating a new invoice from scratch every time, you can use a template to quickly generate professional invoices. These templates are available in different formats such as Word, Excel, PDF, and Google Docs, making them easy to use for businesses of all sizes.

Benefits of Using Invoice Templates

- Professional Appearance

A well-designed invoice creates a positive impression. Clients are more likely to take your business seriously when your invoices look clean, structured, and branded. - Time Efficiency

Instead of building an invoice manually, you can simply fill in details in a pre-formatted template. This saves hours of repetitive work, especially for freelancers and small business owners. - Error Reduction

Templates already include standard fields like subtotal, tax, and total, reducing the chances of mistakes in calculations. - Customization

You can add your logo, brand colors, or specific payment instructions to personalize the invoice while keeping it professional. - Better Record-Keeping

By using uniform invoice templates, your records remain consistent, making it easier to track payments, pending dues, and client history.

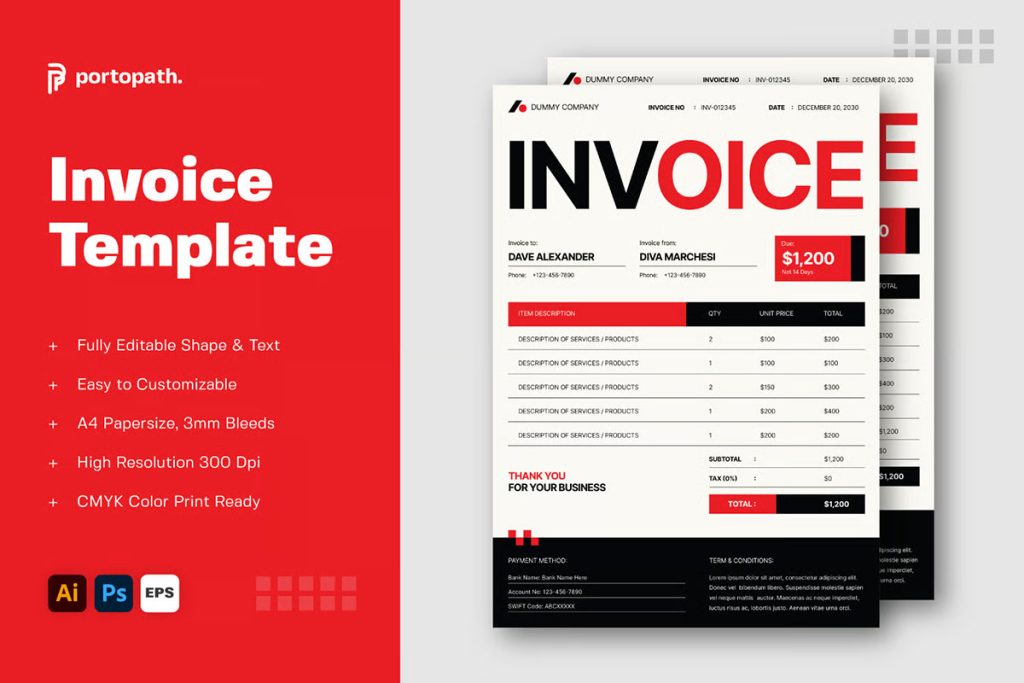

Invoice Template

Invoice Template Word

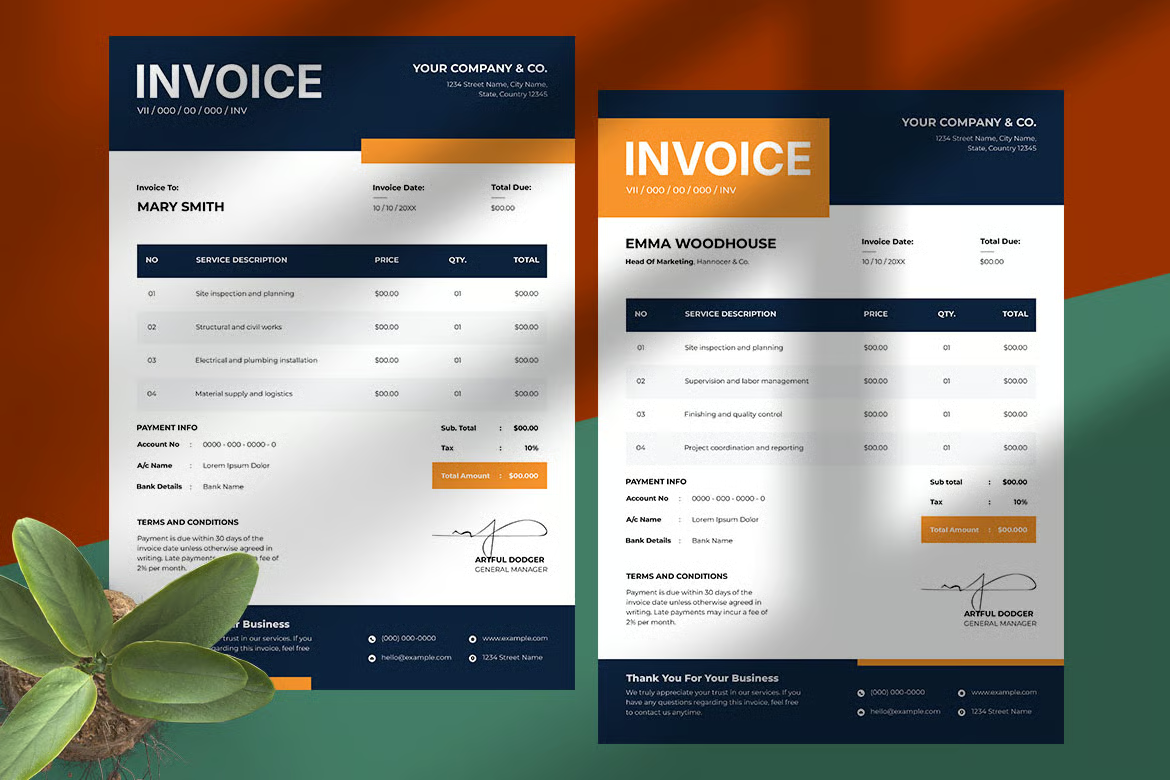

Business Invoice Template

Modern & Versatile Print Invoice Template

Business Invoice Template

Invoice Template

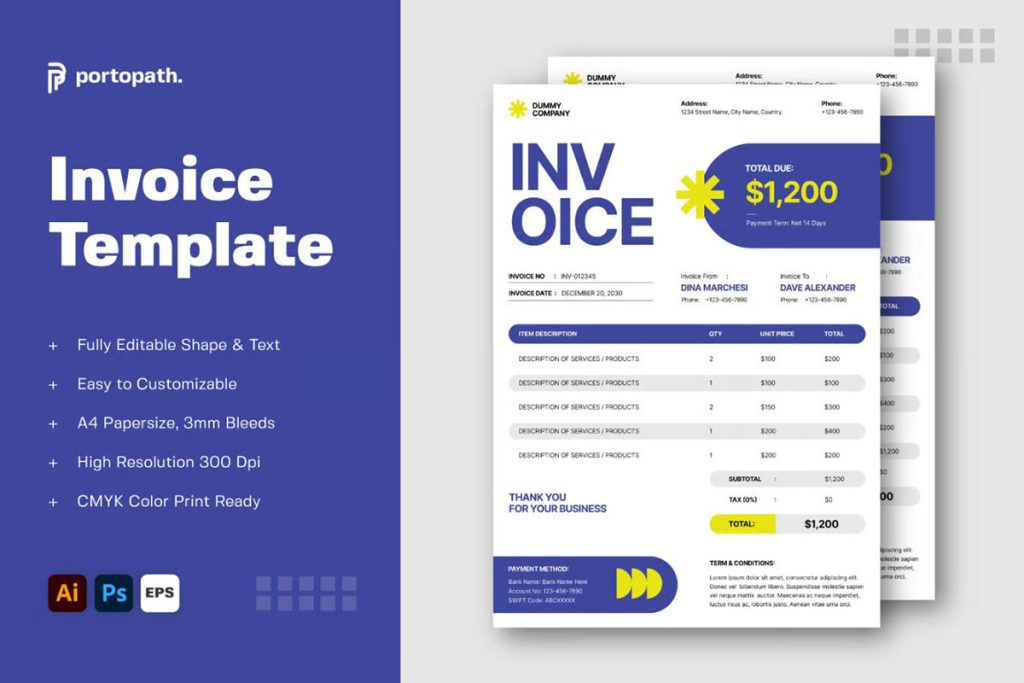

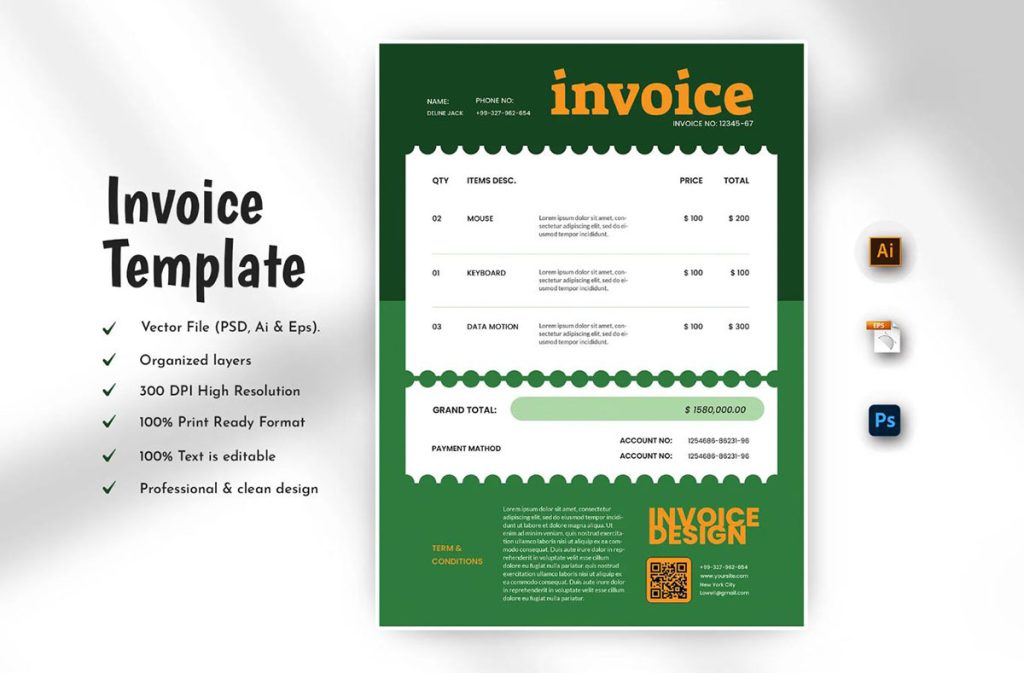

Blue Green Modern Creative Invoice

Designer Invoice Template

Cafe Invoice

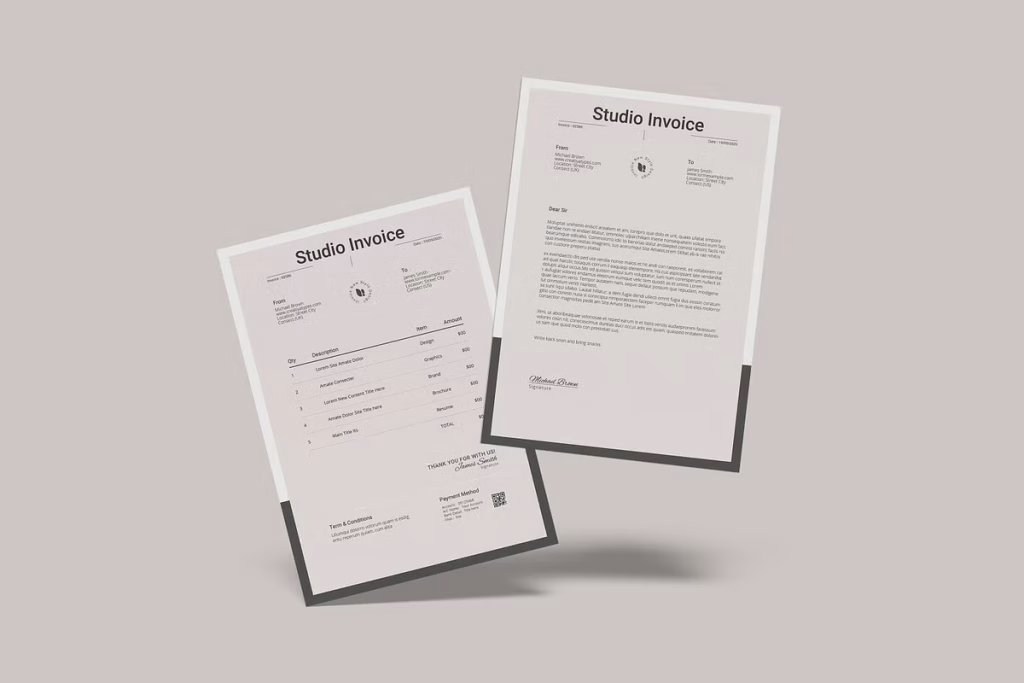

Studio Invoice

Clean Invoice Template

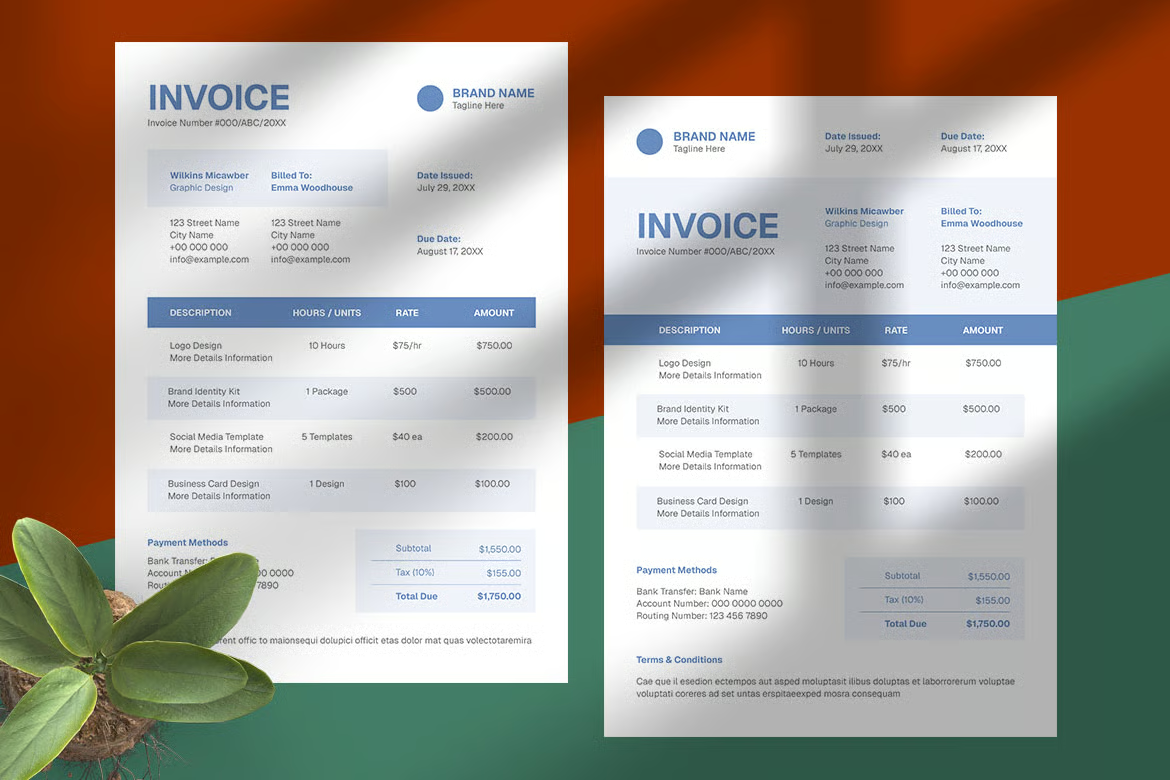

Digital Business Invoice

Restaurant Invoice

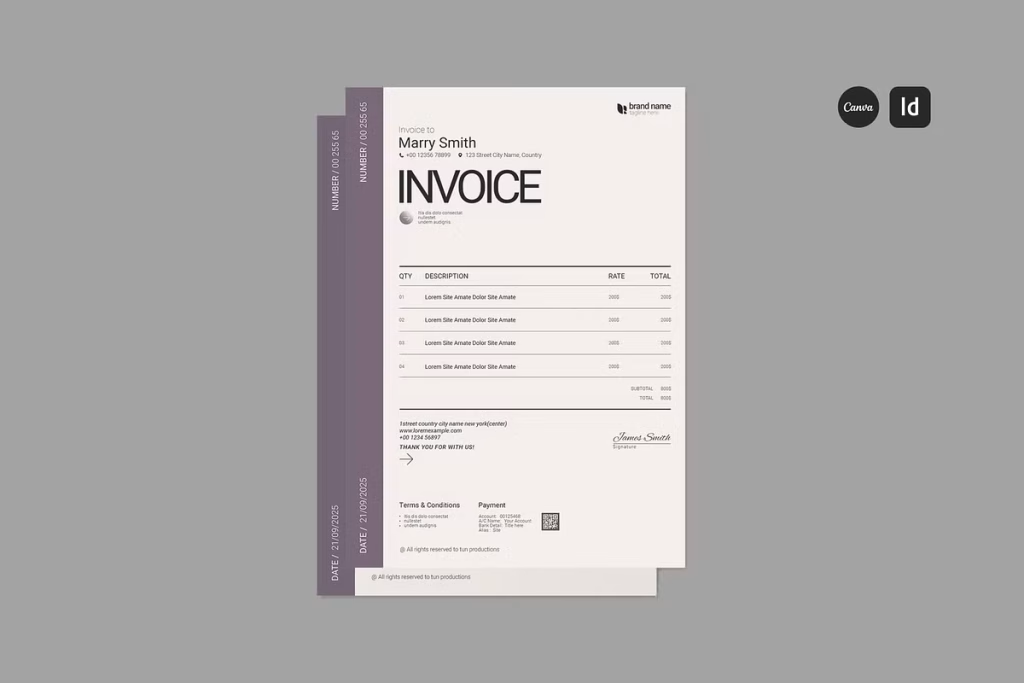

Canva ,Id Invoice Template

Drpping Simple Services Invoice Template

Clean Construction Invoice

Sports Invoice

Hotel Invoice Template

Cleaning Service Invoice Set

Professional Invoice Template

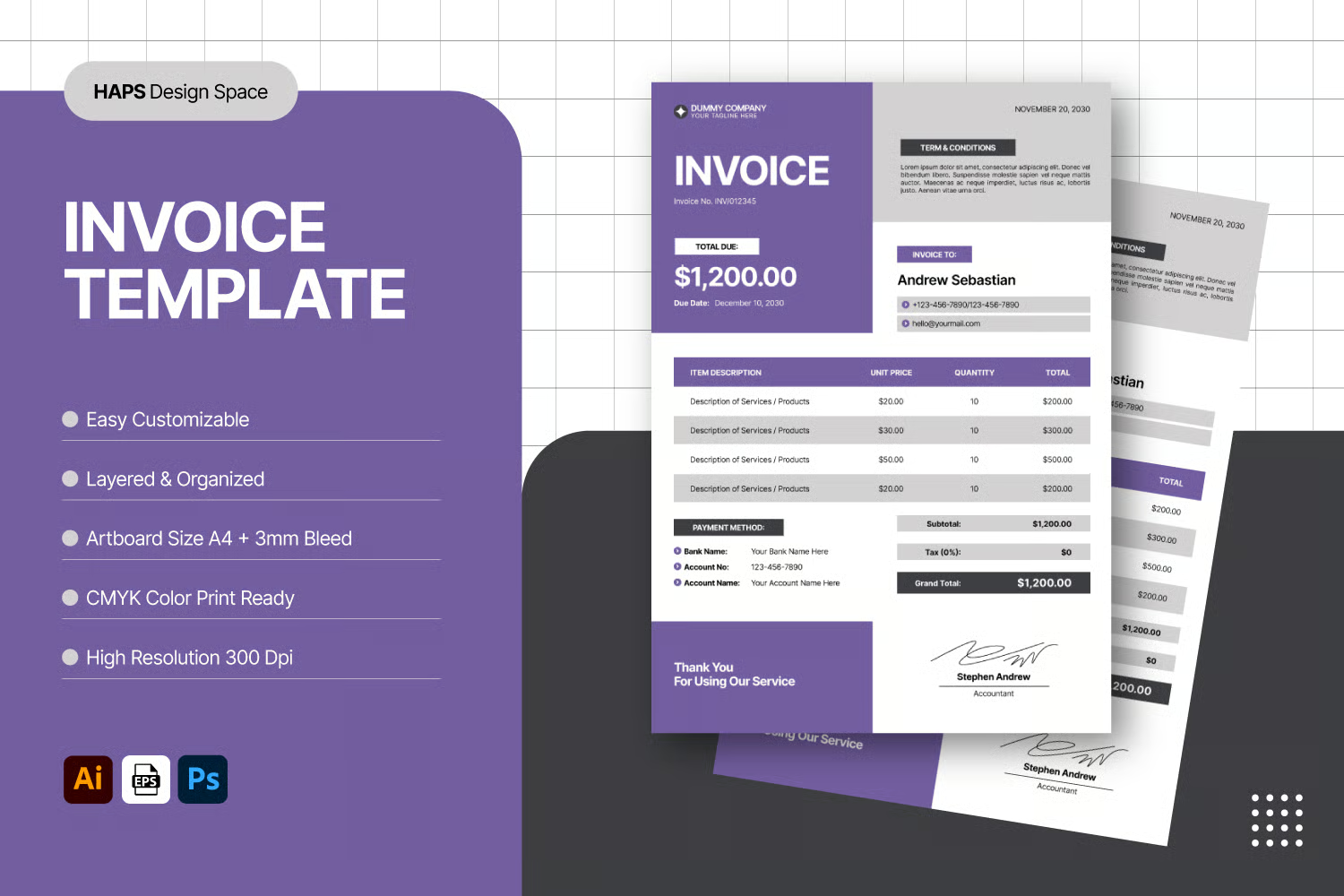

Design Space Invoice Template

Types of Invoice Templates

There are different types of invoice templates tailored to specific business needs:

- Standard Invoice Template – Ideal for general services or product sales.

- Hourly Invoice Template – Designed for freelancers and consultants who bill by the hour.

- Service Invoice Template – Perfect for service-based industries like marketing, IT, or design.

- Proforma Invoice Template – Used to provide clients with an estimated cost before final billing.

- Commercial Invoice Template – Essential for international trade, including customs information.

Popular Formats of Invoice Templates

- Word Templates: Easy to edit and customize with brand details.

- Excel Templates: Great for automatic calculations and tracking.

- PDF Templates: Professional and secure format to send final invoices.

- Google Docs/Sheets Templates: Convenient for online collaboration and sharing.

Tips for Choosing the Right Invoice Template

- Choose a template that matches your industry needs.

- Ensure it has all mandatory fields like invoice number, date, and due date.

- Look for a template that allows customization for your brand identity.

- Pick a format that is easy for both you and your clients to use.

Why Invoice Templates Improve Business Efficiency

Using invoice templates is more than just about design—it’s about efficiency. They help you standardize your billing system, prevent late payments, and maintain financial accuracy. For freelancers, these templates ensure quick turnaround and more professional client communication. For businesses, they provide consistency across departments and save administrative time.

Final Thoughts

If you want to simplify your billing process, save time, and improve professionalism, adopting invoice templates is the way forward. From freelancers to enterprises, everyone can benefit from ready-to-use templates that make invoicing smooth and hassle-free. With multiple formats and customizable options available, you can choose the perfect template that fits your business style and financial needs.