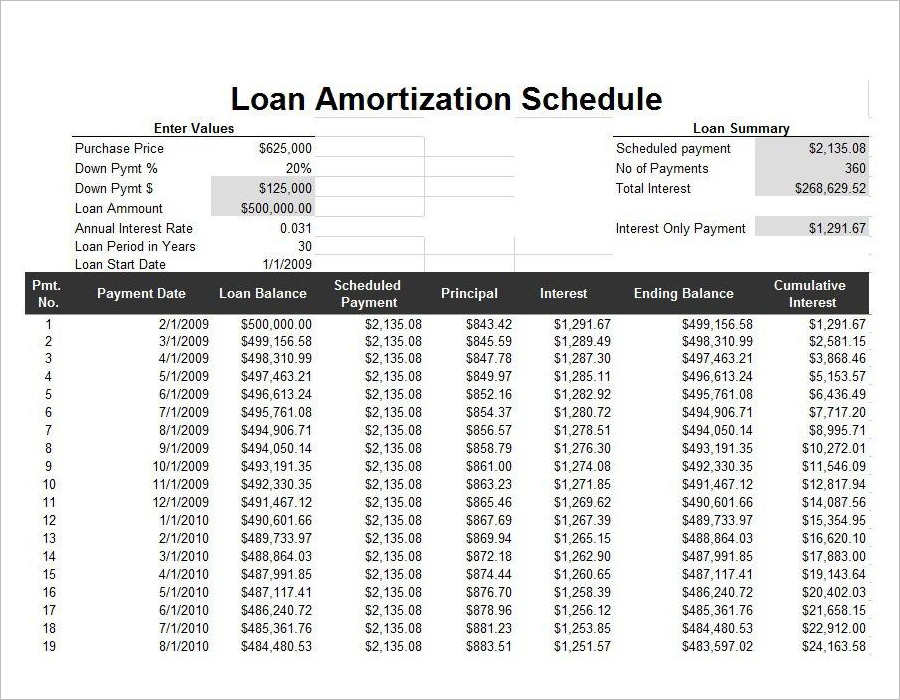

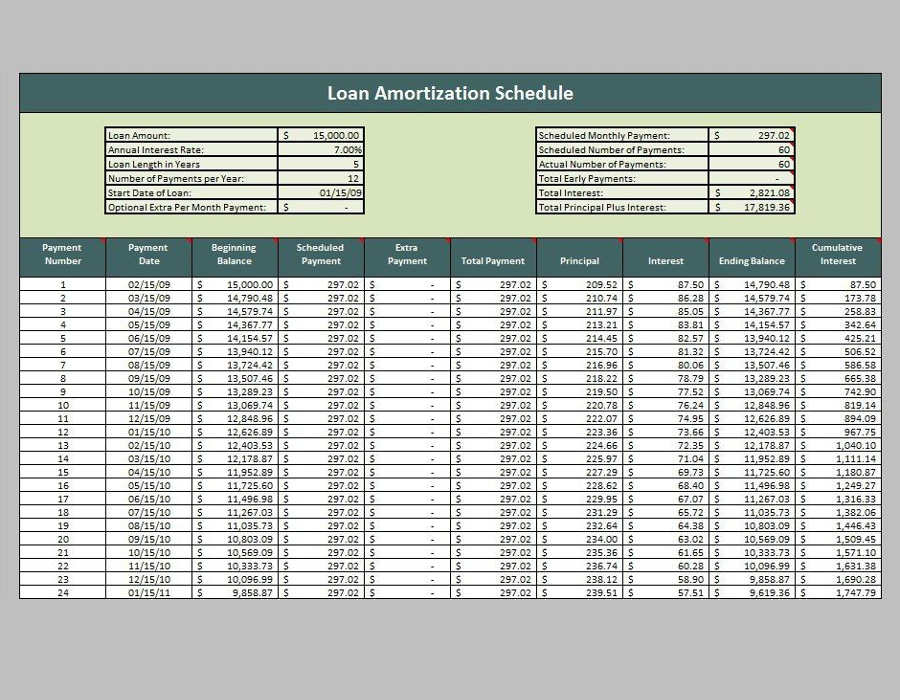

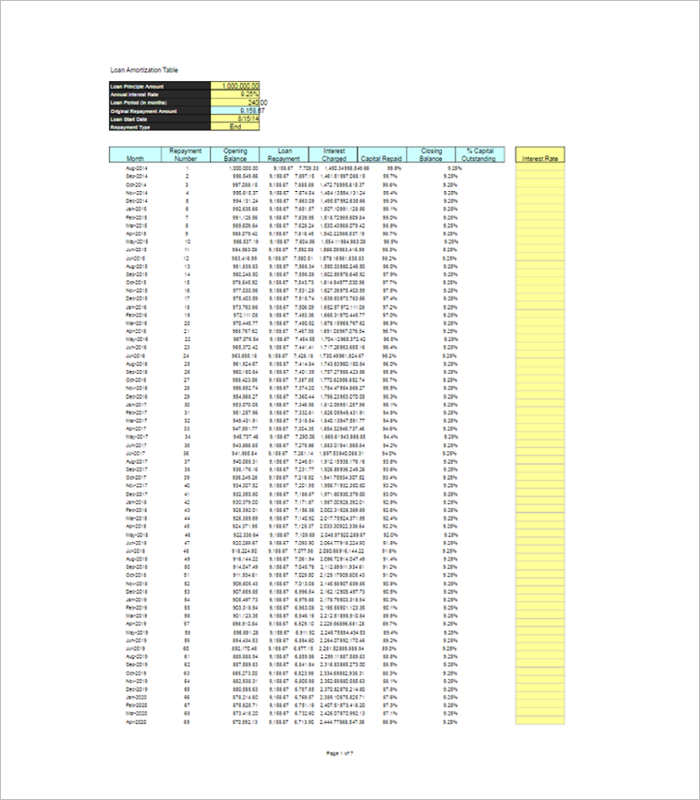

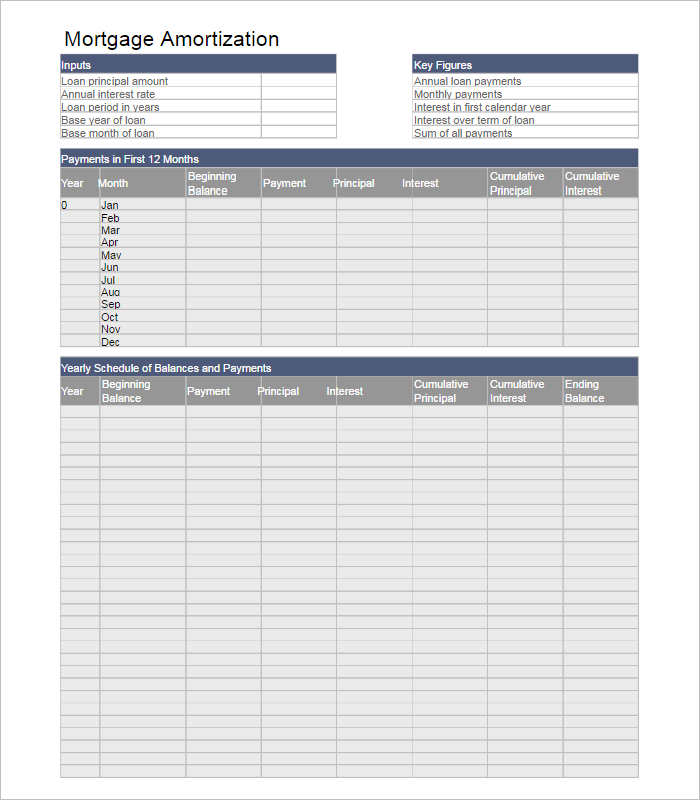

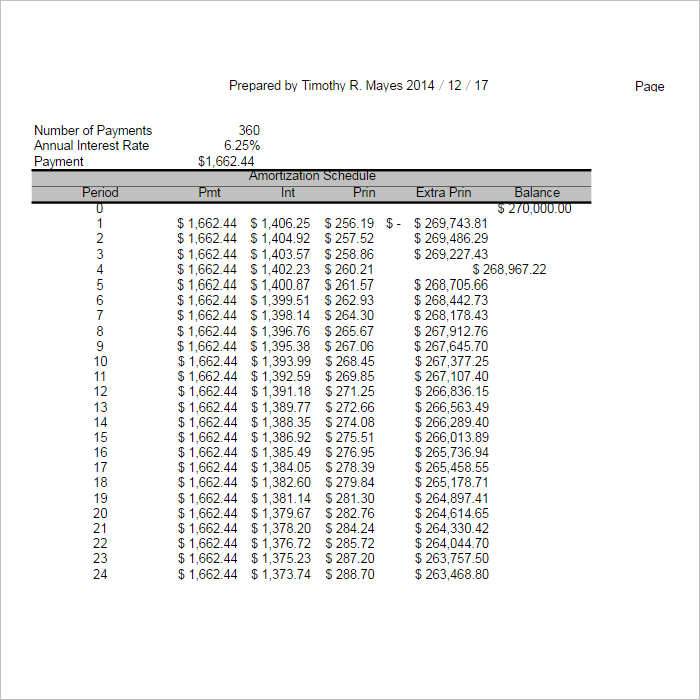

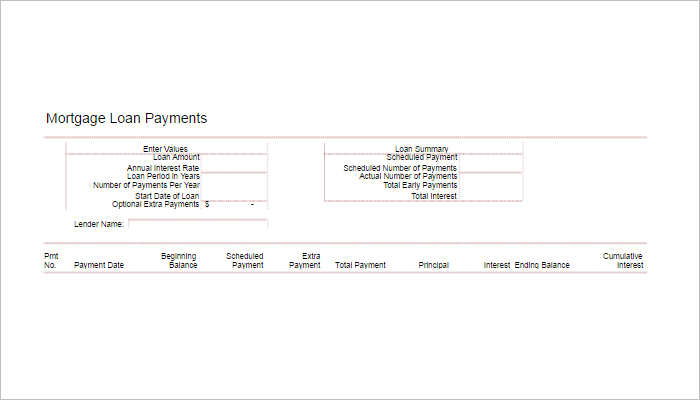

A Loan Amortization Schedule Calculator illustrates the details about the payment of a loan. Like, for example, the due dates, the amount that applies towards the principal loan and the amount that is supposed to go for the interest that has been agreed by the parties as per the agreement. Lots of businesses, companies, and individual’s use these Amortization schedules to keep a track of the recurrent payments for a loan. This schedule lets the user breakdown his loan payments into smaller amounts so that he can match the payment of the loan in time. He would be able to pay his loan in a very organized manner, and it would not pinch him. The Schedule gives you complete details of when and how the loan will be paid off; so one can accordingly plan things.

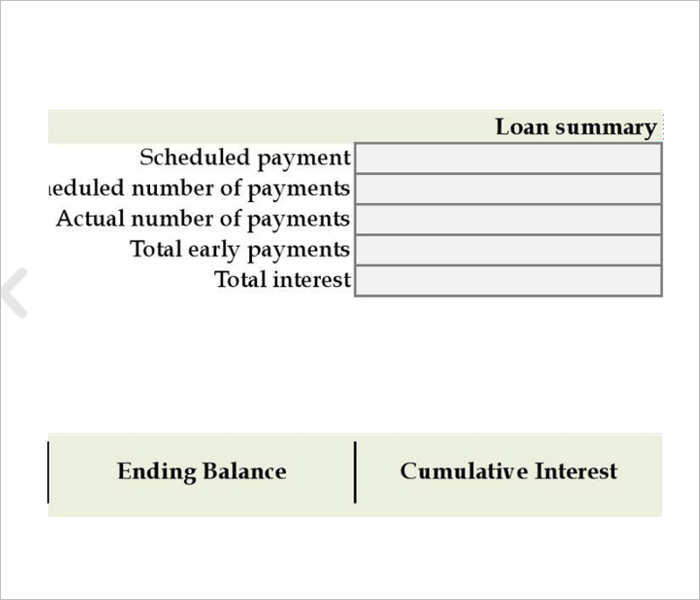

Much to our convenience, these days creating a loan Amortization schedule is not all that difficult. There are lots of free blogs, websites or online stores that give us Amortization Schedule Templates. You just have to edit the template as per your requirements. The Amortization Schedule would calculate the initial balance, the total payment, the principal and interest payments and the ending balance for every period.