The dream of owning a home is a significant milestone for many individuals and families. Yet, the process of purchasing a residence involves various legal and financial considerations. At the heart of this transaction lies the residential purchase agreement, a pivotal document that outlines the terms and conditions of the sale. In this article, we delve into the intricacies of residential purchase agreements, shedding light on their importance and key components.

Defining the Foundation: What is a Residential Purchase Agreement?

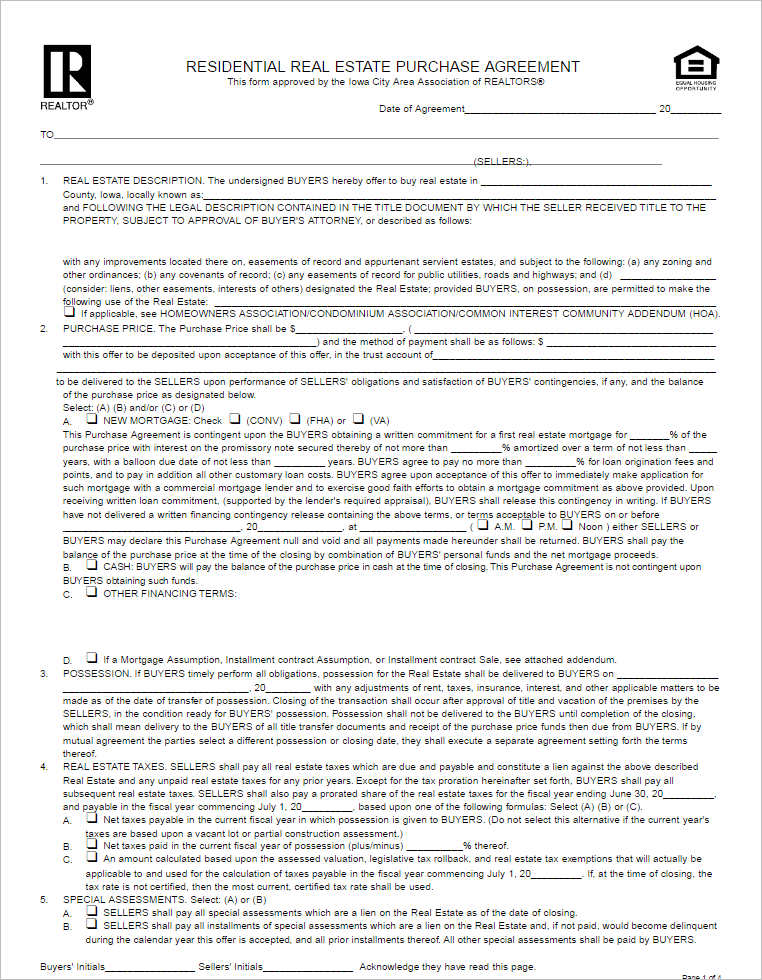

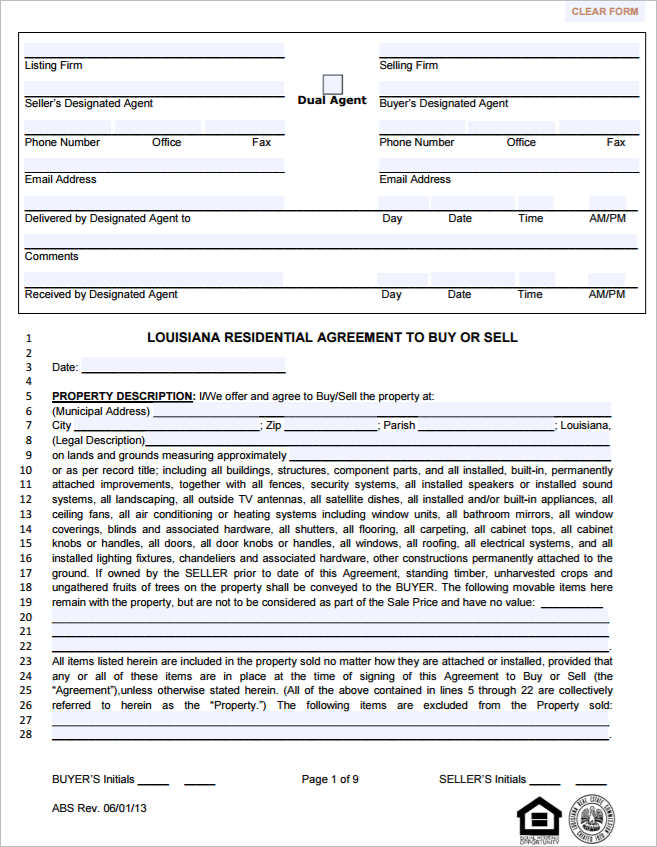

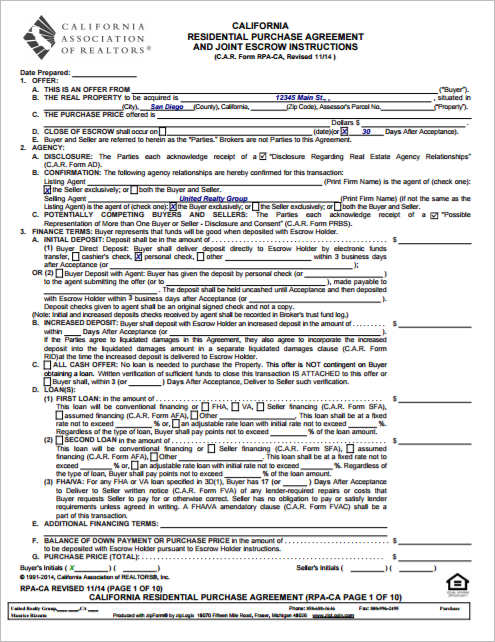

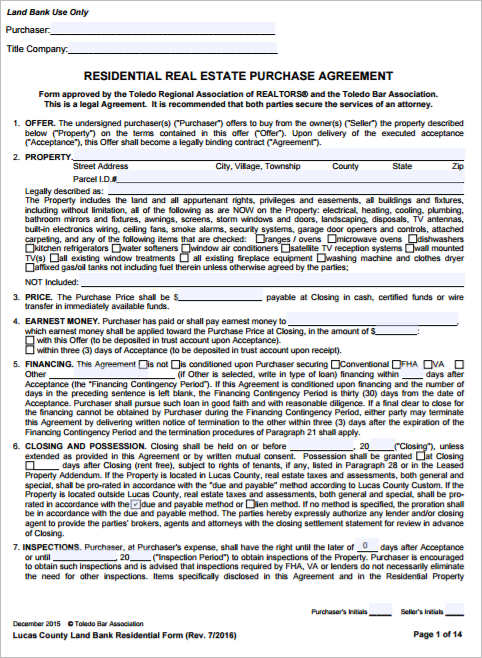

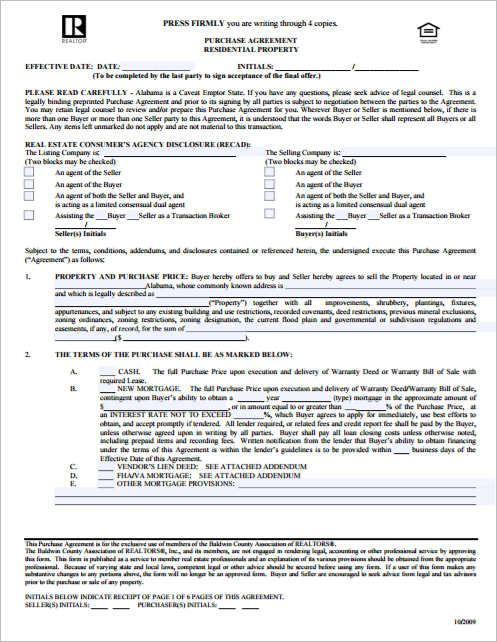

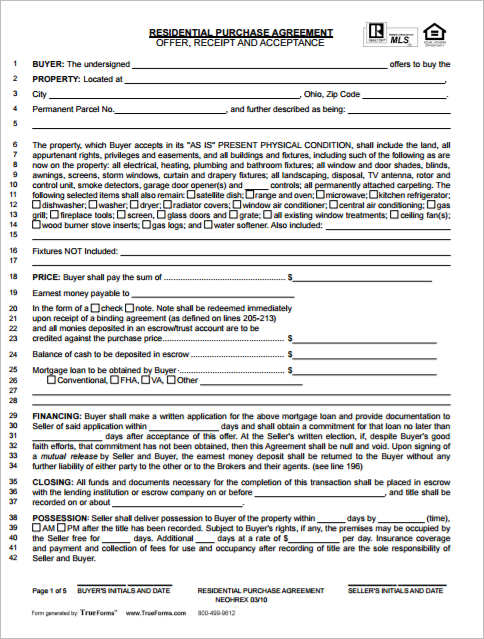

A residential purchase agreement, often referred to as a purchase and sale agreement or contract, is a legally binding document that facilitates the sale of a residential property. It serves as a roadmap for the transaction, detailing the rights and obligations of both the buyer and seller. This agreement covers essential aspects such as the purchase price, financing arrangements, contingencies, and the timeline for closing the deal.

Clarity in Transaction: The Importance of Residential Purchase Agreements

The significance of a residential purchase agreement cannot be overstated. By clearly delineating the terms of the sale, this document minimizes misunderstandings and disputes between the parties involved. From specifying the condition of the property to outlining the responsibilities regarding repairs and inspections, the agreement provides a comprehensive framework that safeguards the interests of both the buyer and seller. Moreover, it offers legal protection and recourse in the event of breaches or disagreements.

Key Components: Understanding the Elements of Residential Purchase Agreements

A well-crafted residential purchase agreement comprises several essential elements:

1. Property Description: This section provides a detailed description of the property being sold, including its address, legal description, and any relevant identifiers.

2. Purchase Price and Payment Terms: The agreement specifies the purchase price agreed upon by the buyer and seller, as well as the terms of payment, including the deposit amount and the schedule for additional payments.

3. Contingencies: Contingencies are conditions that must be met for the sale to proceed. Common contingencies include financing, appraisal, home inspection, and the sale of the buyer’s existing property.

4. Disclosures: Sellers are typically required to disclose certain information about the property’s condition, history, and any known defects or issues.

5. Closing Date and Escrow: The agreement stipulates the date of closing, as well as the procedures for handling earnest money deposits and escrow accounts.

Conclusion: Empowering Homebuyers with Residential Purchase Agreements

In the journey towards homeownership, residential purchase agreements serve as invaluable tools, providing clarity, protection, and peace of mind to both buyers and sellers. By understanding the intricacies of these agreements and working with knowledgeable professionals, individuals can navigate the complex process of purchasing a home with confidence and ease. From negotiating terms to signing on the dotted line, the residential purchase agreement paves the way for the realization of the dream of owning a home.